georgia ad valorem tax motorcycle

Registration Fees Taxes. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015.

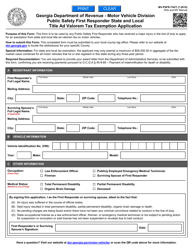

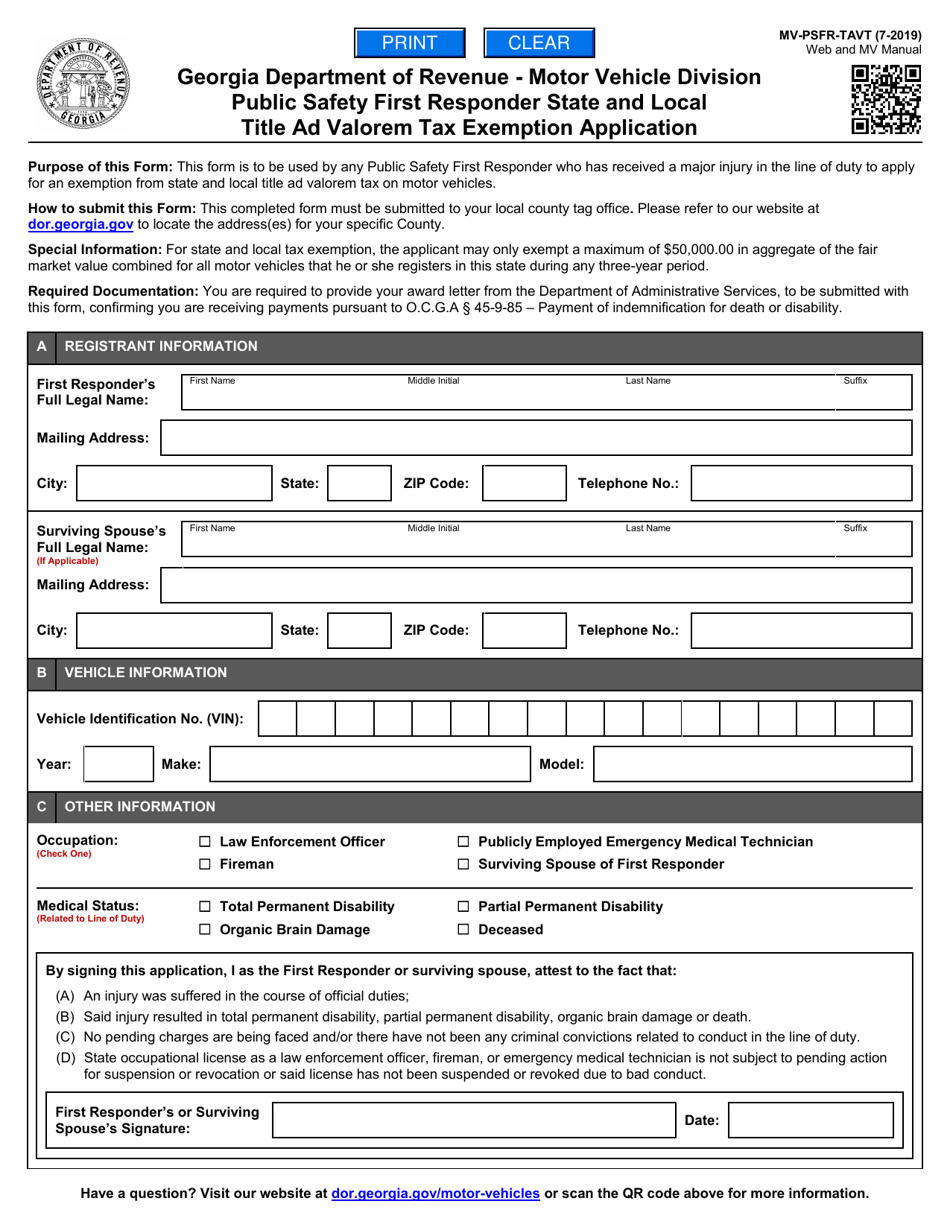

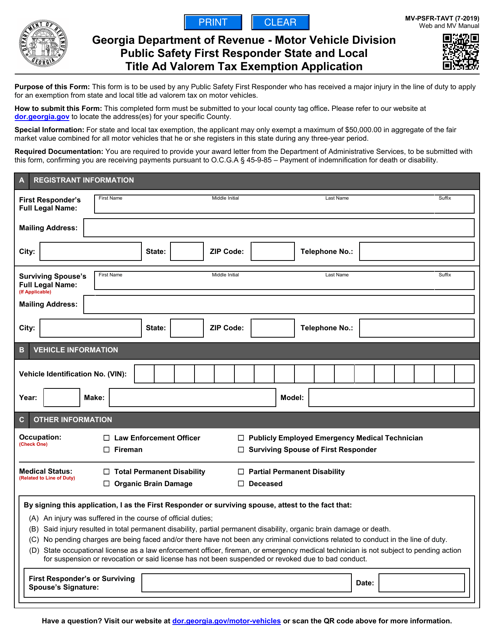

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

If your registration is paid after your birthday due date then you are responsible for all applicable late.

. 20 Annual License Reg. Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows. You will now pay this one-time.

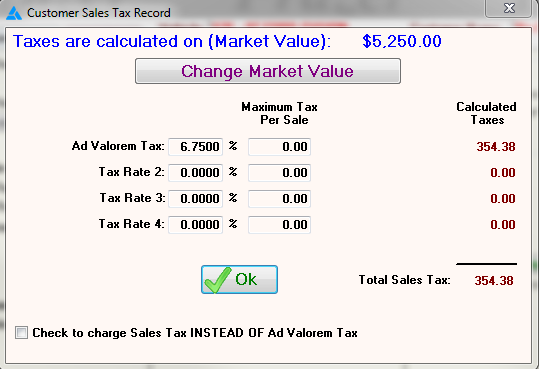

Cost and Fees Distribution. This calculator can estimate the tax due when you buy a vehicle. 2012 Black Cross Country.

TAVT rates are set by the Georgia Department of Revenue. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. Vehicles subject to TAVT are exempt from sales tax.

I think it starts out around 30 per year on a new bike and it goes down a little each year until the vehicle is. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their. This tax is based on the value of the vehicle.

If itemized deductions are also. Anybody registered a 2012 or 2013 victory in Georgia brought in from another. Georgia requires minimum-liability insurance on all motor vehicles.

Then it is just a yearly registration fee after that. 59 to State of Georgia General Treasury. 1 to the County Tag Agent.

393 Type of Motorcycle Currently Riding. Georgia ad valorem tax motorcycle Wednesday March 9 2022 Edit. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

The amount is calulated on the purchase price less any trade-in value. Motorcycles may be subject to the following fees for registration and renewals. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA. Military members are exempt from assessment and property taxes upon registration renewal. For tax year 2018 Georgias TAVT rate is 7 prtvrny.

Based on the market value of your motorcycle. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. 18 title fee and 10 fees for late registration.

5500 plus applicable ad valorem tax. 80 plus applicable ad valorem tax. The actual filing of documents is the veterans responsibility.

In South Dakota we pay a one-time 3 excisesales tax the first time we register a vehicle. As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle.

66 title ad valorem tax TAVT. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Based on weight 12 minimum 5.

Valid drivers license or picture ID. This means that it will vary depending upon whether it is a new motorcycle that you have bought or a used one. 2021 Property Tax Bills Sent Out Cobb County Georgia 25 of the tag fees.

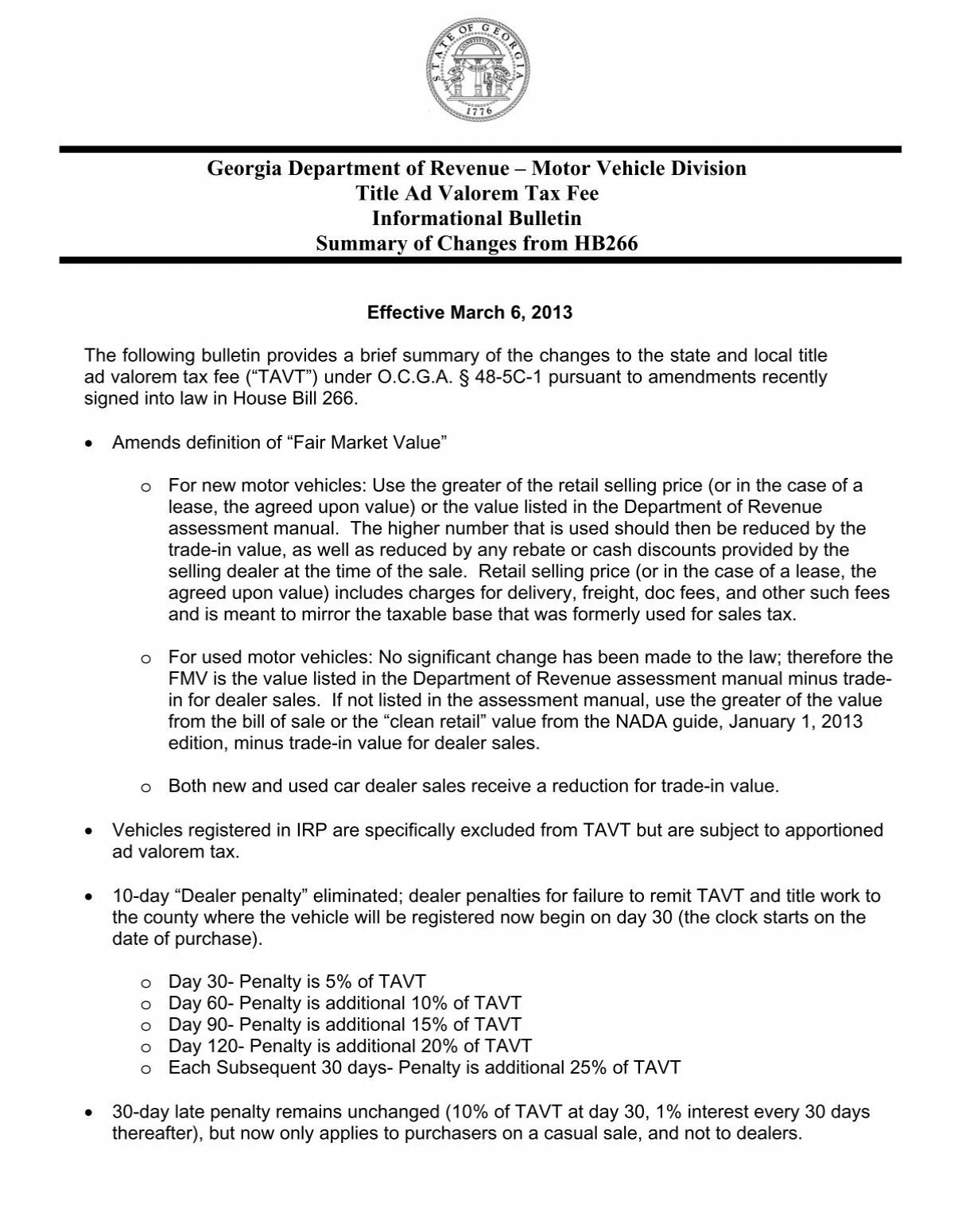

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time.

Cost to renew annually. As an example if the fair market value of a used vehicle in Georgia is 14000 the TAVT that the owner of the automobile is required to pay. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia.

For an estimate use the MVDs ad valorem tax calculator. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Jan 14 2015 1.

Title Ad Valorem Tax TAVT became effective on March 1 2013. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. This tax law Annual Ad Valorem Tax is calculated by the vehicle values set by the Georgia Department of Motor Vehicle Division and multiplied by the mill rate set by the governing authorities state school county water authority.

Jul 26 2012 Messages. It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year.

Georgia Used Car Sales Tax Fees

Georgia Title Ad Valorem Tax Updated Youtube

Georgia Net Tax Collections Increases To Over 2 2b Valdosta Today

Tax Rates Gordon County Government

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application

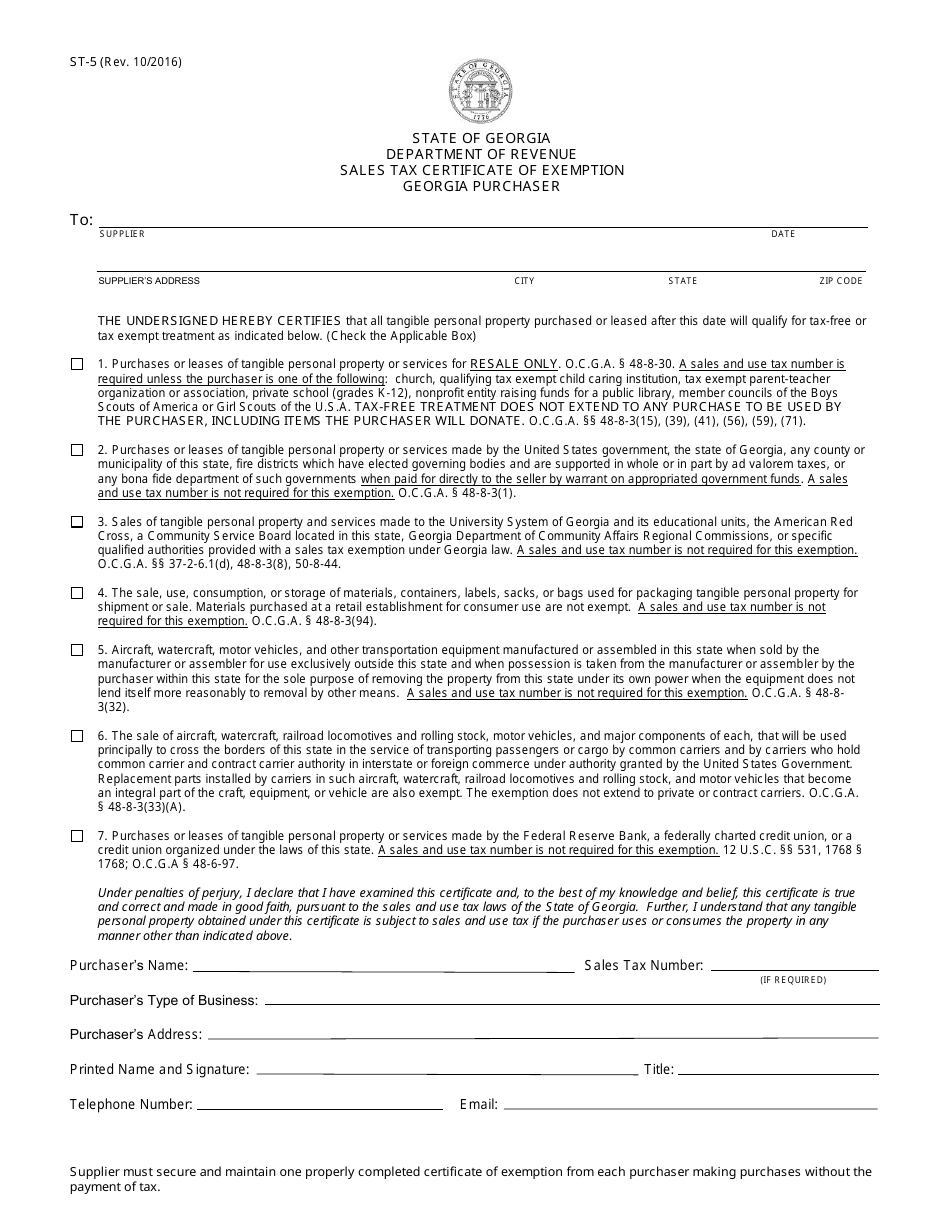

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

![]()

Georgia New Car Sales Tax Calculator

Frazer Software For The Used Car Dealer State Specific Information Georgia

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

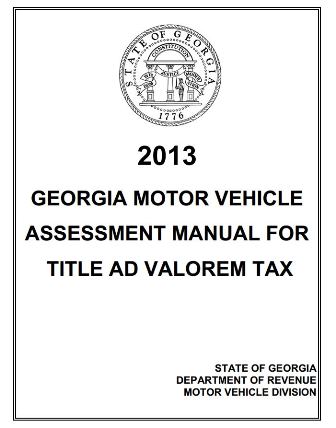

Georgia Motor Vehicle Ad Valorem Assessment Manual

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Georgia Department Of Revenue Property Tax Assessments And Appeals Committee Meeting October 29 Ppt Download

Georgia Department Of Revenue Property Tax Assessments And Appeals Committee Meeting October 29 Ppt Download

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Laziness Could Lead To Smaller Brain Size Car Insurance Claim Car Insurance Farmers Insurance

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price